This just arrived in the morning post…

It’s my husband’s latest eBay victory. A genuine thistle (decal) shot glass. One of a set of four (although he only bought three of them, because the 4th one was listed as cracked and so during the comms part of the excitement, he told the sellers they could just keep the broken one.)

ME: How much did you spend on this?

HIM: Uhm… I can’t remember. Maybe a fiver? Continue reading

Watching the Iron Lady was a deeply unsettling experience on several levels. Although I never met Margaret Thatcher, she has been a significant motif in my adult life. There were several decades where it seemed I could hardly turn on the radio or TV without hearing her referenced in some way. Which made seeing Meryl Streep’s uncanny portrayal of her in the Iron Lady feel quite personal somehow. In my own case, this was all the more true because the film centres on the late PM’s descent into Alzheimer’s – a disease which, unlike Maggie, I have unfortunately met, and more than once now.

Watching the Iron Lady was a deeply unsettling experience on several levels. Although I never met Margaret Thatcher, she has been a significant motif in my adult life. There were several decades where it seemed I could hardly turn on the radio or TV without hearing her referenced in some way. Which made seeing Meryl Streep’s uncanny portrayal of her in the Iron Lady feel quite personal somehow. In my own case, this was all the more true because the film centres on the late PM’s descent into Alzheimer’s – a disease which, unlike Maggie, I have unfortunately met, and more than once now.

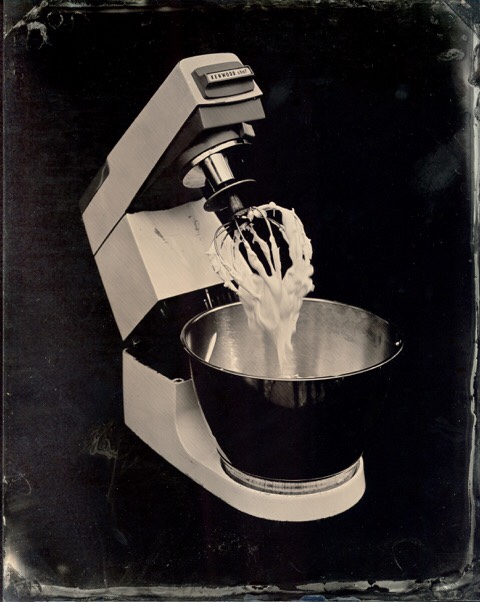

My husband, a photographer who specialises in antiquarian photographic processes, decided to have a go at teaching me to a wet plate collodion image. He started by asking me to have a think about what I’d like to shoot, and then rejected all my suggestions on the basis that they weren’t ‘still’ enough. ‘Pick something that can’t move. Ideally, a heavy object. How about your Kenwood mixer?’

Because what girl doesn’t want a photograph of her kitchen mixer, right? Continue reading

It should have been a lovely day. Yes, there was a brisk chill in the air, but the sun was ’splitting the sky’, as my mother-in-law was fond of saying, as we drove off to see her for a spot of birthday afternoon tea. We had stopped off to buy an assortment of cupcakes and chocolates, and my husband had chosen a gorgeous bouquet of flowers. For the past few years, when looking after her at home stretched us to breaking point, my husband’s mother has has been living in grand old house tucked away in the English countryside. From the dangling wisteria, to the endless offerings of toasted tea cakes, it’s all very National Trust – only with locks on the doors and handrails and wheelchair ramps tastefully fitted into the mahogany panelling. Continue reading

‘Sometimes you can look at a painting and think, that’s a lovely eye. It’s just in the wrong place.’

I find it endlessly fascinating to see the way one art form overlaps with another, and once you look past the dazzling watercolours and oil paints, Sky Arts Portrait Painter of the Year is really a master class in writing techniques. Portraiture is, of course, all about conveying character in brush or pencil strokes. Writers […]

Hope it works for you, too. (Big thanks to Sumit for the tip off…) Jamie xx: Sleep Sound on Nowness.com

Field Of Light

Simple idea, beautifully executed. You will feel just that wee bit more Zen after watching this, I promise.

I get my picture taken a lot. On a bad day, this can mean dozens of times. The reason? Usually, it’s because I am ‘there’; standing around on the set of a shoot my husband is setting up, and therefore a sitting duck for any other photographer who happens to have their camera in hand and wants to just ‘check the light’ and what it is doing to skin tones.

I get my picture taken a lot. On a bad day, this can mean dozens of times. The reason? Usually, it’s because I am ‘there’; standing around on the set of a shoot my husband is setting up, and therefore a sitting duck for any other photographer who happens to have their camera in hand and wants to just ‘check the light’ and what it is doing to skin tones.

Until recently (like ten days ago) I absolutely hated having my picture taken. Then, last Sunday, I was standing around on an outside location shoot at which a group of photographers had turned up to help (it’s has been my experience that photographers travel in packs, or herds even). Elizabeth Molineux was on hand, ‘testing’ a camera she had borrowed for a particular job she was doing later in the week. This ‘testing’ involved picking people off from the herd one-by-one, and holding her lens a few millimetres from their faces. Continue reading